Car Loan Settlement Process Malaysia

For foreigners who wish to sell used cars in Malaysia it is possible. The motivation behind making early settlement largely boils down to one reason - avoiding the interest charges in the later period.

How To Assess The Benefits Of Nonperforming Loan Disposal In Sub Saharan Africa Using A Simple Analytical Framework In Imf How To Notes Volume 2021 Issue 006 2021

Car Loan Early Settlement Malaysia If you make a car loan contract for 9 years.

. First of all you need to know how much your monthly and annual income is because this is one of the most basic eligibility requirements. We are contactable 247 603 6204 7788. Your car loan total is 30K.

Your existing hire purchase loan is settled and you can get your new car without any worries. A used car with proper service records along with receipts usually means the cars well-maintained. To illustrate further see the car loan.

First get the car inspected by Puspakom and then head to JPJ. If its RM55000 an approved loan is RM55000. Car Loan Early Settlement Malaysia If you make a car loan contract for 9 years.

Manage your cashflow effectively as instalments are fixed over the agreed repayment period. JPJ K3A form this is different from the K3 form which is for voluntary transfers. Bursa Depository Transfer Details of transfers are updated on an immediate basis.

After paying the interest for several years some people might make early settlement to repay car loans in full. If its RM65000 - an approved loan is RM59900. Its worthy to note that there is NO other service like the Carlistmy Essential Services program especially at those rates.

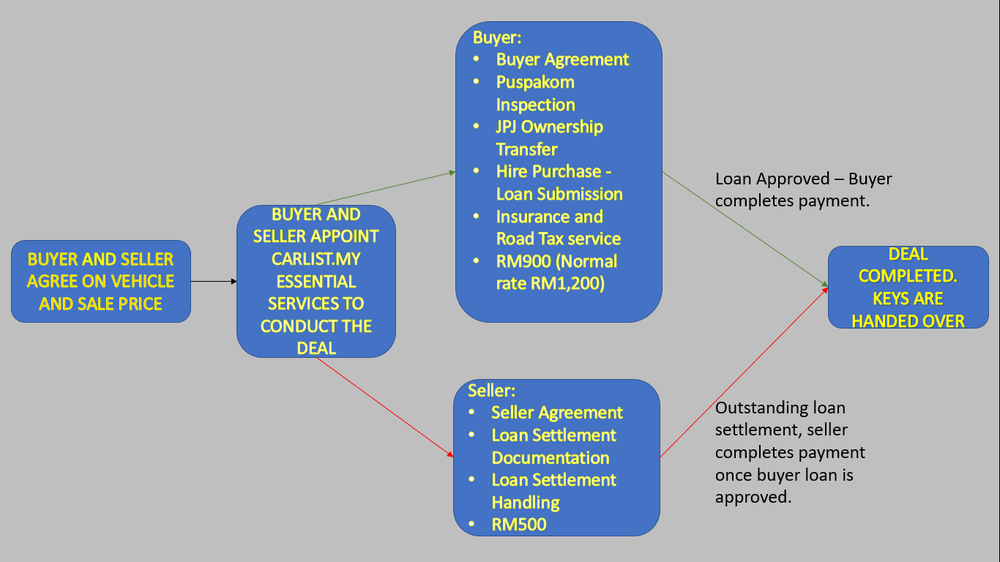

As for the seller there is a charge of RM500 for the Loan Settlement Handling process meaning Carlistmy will handle the remaining loan settlement charges and paperwork for your car once the buyers loan has been approved. Securities are available in the recipients account with same-day value and the payments are received later in the day for delivery trades. Below is a summarised diagram of a typical car loan application process in Malaysia.

Loan Tenure Repayments and Early Settlement. After you complete the installation of the car loan you will be contacted by the bank to collect the Settlement Release Letter to show that you have completed all your payments Also to collect the vehicle registration card if you have never collect before. Youll need to pay off your loan first Image from GIPHY.

For example base on the above criteria. Car Loan Settlement Calculator Tips Aka car loan redemption calculator. To ensure you qualify for a car loan you have to be sure that you provide all the necessary documents for your application.

But before that you need to take note that banks usually only allow you to sell your car or trade it in after 5 years for a car loan term of 9 years and after 4 to 5 years for a car loan term of 7 years. Car loans are one of the most prevalent types of loans undertaken by Malaysians. The IC of the person in charge of handling the deceaseds matters.

You can also use loan calculators to check the rates according to the price of the car down payment interest rate and salary. Bank Name Car Loan Interest Rates. Once the application and documents are submitted it is up to the bank to decide on the approval of.

Depending on the type of loan undertaken you may save money with early settlement. A clean and prompt service record shows a responsible owner. Prefer to meet us in person.

They will ask you to verify some details after which they will inform you how much is the outstanding balance. In Malaysia you may take out a car loan for a minimum of 1 year to a maximum of 9 years. ISS settlement ISS settlement eliminates the settlement risk of the Bursa Depository Transfer method by exchanging.

You need at least RM2000 gross monthly salary for a car loan in Malaysia. The car loan application process. The bank or lender will then inform the dealer how much is needed to settle the loan debt and inform them by what date payment must be received.

Next the car has to have a B5 puspakom inspection form to proceed to the final ownership transfer step. A car loan settlement calculator helps you to calculate the amount you will need to pay to settle. Firstly the cars loan must be completely settled prior to sale.

The dealer will call the bank or lender who holds the loan on your old car and ask for an auto loan settlement or payoff amount. Eyeing on a new car. With RHBs Auto Financing you can now finance your dream car with ease.

Car owned by a foreigner or expatriate. I signed up six years repayment term and paid RM404 as monthly installment. If you have a cash to make lump sum you should try this.

There a balance for 5 years to go. If im not mistaken will take about 1 week to process early settlementpayoff of the HP. The interest rate is priced at 340 annually and you can extend the repayment period for as long as 9 years.

Principal Amount RM Loan Period Years Interest Rate Total Hiring Charges. This process is called Loan Settlement. And you already made a payment for 4 years.

3 After processing I was told to go to JPJ Office and get a chop on the car grant original grant is with me. You can contact the bank or finance house and inform them you would like to made full settlement to your car loan. But you can settle your car loan early and earn interest from FD and rebate from bank by Full Settlement I financed RM20000 to buy a Proton Saga in 1999.

For the purchase of a new car Maybank is offering up to 90 margin of finance with you covering the remaining 10. The interest for car loan was 76 at that time very high but lower than few months before I took the loan. At JPJ youll need to have the following things.

If you did not get it then contact the bank to locate the letter. What will I get after processing. In this example you select Maybank Hire Purchase to finance your car purchase.

Our financing package caters to all new used or unregistered reconditioned motor vehicles. Depending on your loan amount and interest rate employed your monthly repayments will be bigger for shorter-tenured loans. Usually in Malaysia a car loan can up until 9 years.

Second and subsequent vehicle loans to the officer is allowed after five 5 years from the date of approval provided that the existing loan has been fully settled. The official JPJ chop supposedly to proof there is no loan attached to the car. Car loan settlement calculator estimates your total amount payable and savings for early repayment on your vehicle bought through hire purchase.

Car Loans - Monthly Installment Calculator. AmBank Arif Hire Purchase-i. This is because some banks impose fines or penalties for early loan.

The deceaseds original death certificate. In my case- My Loan was 47000 Interest rate was 25 Interest incur was 8225 Total loan was 55225 Tenure was 84 mths. Alliance Bank Hire Purchase.

A Guide To Car Loans Interest Rates In Malaysia

How Banks Fooled You With The Rule Of 78 Rule Of 78 The Fool Learning Centers

Sample Letter Format For Surrender Of Life Insurance Policy Life Insurance Policy Insurance Policy Lettering

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

How To Calculate Your Car Loan Monthly Instalments And Interest

/terms-c-cross-collateralization-0cb8f66776c346949f9b7cf236ecefbc.jpg)

Cross Collateralization Definition

International Bank For Economic Co Operation Ibec Financial Institutions

International Bank For Economic Co Operation Ibec Financial Institutions

Do You Know About The Rule Of 78 Imposed On Early Settlement Of Loans The Star

10 Best Ways To Pay Off Car Loan Faster

How To Assess The Benefits Of Nonperforming Loan Disposal In Sub Saharan Africa Using A Simple Analytical Framework In Imf How To Notes Volume 2021 Issue 006 2021

International Bank For Economic Co Operation Ibec Financial Institutions

Public Bank Berhad Hire Purchase Vehicle Financing

International Bank For Economic Co Operation Ibec Financial Institutions

Here Is A Solution To All Those Problem Which Makes You To Step Back In Investing Money In Any Startup T Investment Services Investment Firms Investment Tools

The Easiest And Cheapest Way To Sell Your Car If It Has An Existing Hire Purchase Loan Buying Guides Carlist My

Chinese Investors Are Pushing Into Melbourne And Sydney Buying Property First Home Buyer Investment Property

Explainer Paid The Last Emi On Your Car Loan Know The Five Things You Need To Do Right After

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

Comments

Post a Comment